Students Gather to Observe Largest Bond Sale in RRISD’s History

November 22, 2019

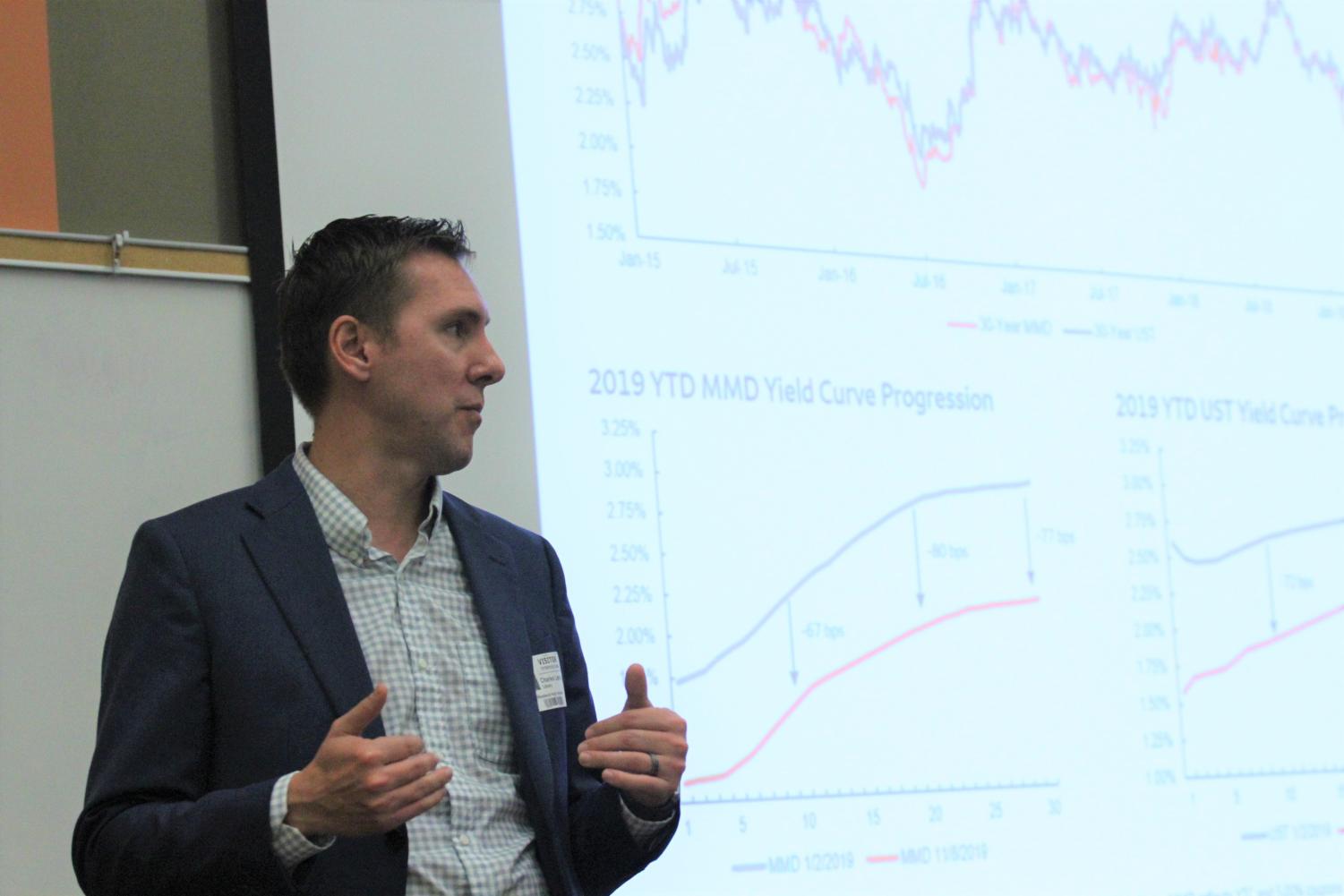

During the largest bond sale in RRISD history, several representatives of Wells Fargo, one of the underwriters of the sale, came to Westwood to teach students while giving them an inside look into the sale on Tuesday, Nov. 19. While they gave students background information on bonds, they gave students updates on the sale that was occurring in that moment.

“[The goal] was to let [the students] get a real-life experience of what happens behind the scenes and understand how bonds work,” business teacher Mr. John Garza said. “[I also wanted them to know] when we vote for a bond, what does that actually mean?”

The representatives began by giving the students some background knowledge on bonds by describing the meaning of a bond and then going into the specific ratings that measure the level of risk that comes with buying a bond. For example, the RRISD bonds that they sold on Tuesday, Nov. 20 had a AAA rating, the best a bond can have.

“[Going in,] I knew what bonds were vaguely, but I didn’t really know the details,” Abhiyan Bhandari ‘21 said. “I learned a lot about the rating system and I didn’t know that we [had] the best [rating].”

The high rating of the RRISD bonds meant that they were a very safe investment, and that was proven when they were opened to buyers. In less than an hour, more than $400 million worth of bonds had been sold.

“I was really excited because all that money is obviously going to go towards our school, and other schools like us,” Sakshi Dhavalikar ‘21 said. “I never really realized that that much money is even needed for the district to maintain good education.”

In addition, the representatives put a website that tracked the sale of the bonds up on the projector for all of the students to see. While the students watched the purchases happen, the representatives asked the students and fielded questions from them about the reasons behind trends in the sale, such as the long-term bonds being a more popular investment.

“It was a pretty cool and interesting experience [to see the bonds being sold],” Owen Ferriola ‘21 said. “It was especially cool because it was our district so it will really impact us.”

At 9:30, the desk in New York was called and students had a chance to listen to an update on the sale and hear from the RRISD CFO Kenneth Adix.

“It was really, really cool because it was live and he had a lot of energy,” Bhandari said. “The [desk] also had a very educational enthusiasm and they really wanted everyone to learn. I liked how he kept asking [if we had] questions.”

Finally, the representatives wrapped up by giving a brief description of their day-to-day life on the job. The details gave students a chance to hear about real job opportunities.

“That was pretty cool because I’ve actually been considering possibly going into sales [or another business field] and I’ve been taking a few business classes,” Ferriola said. “So it was a great opportunity to hear what a career would actually look like.”

The goal of the representatives was to give students the opportunity to hear about and see the real-life application of business knowledge while teaching students about a subject that isn’t always taught in depth.

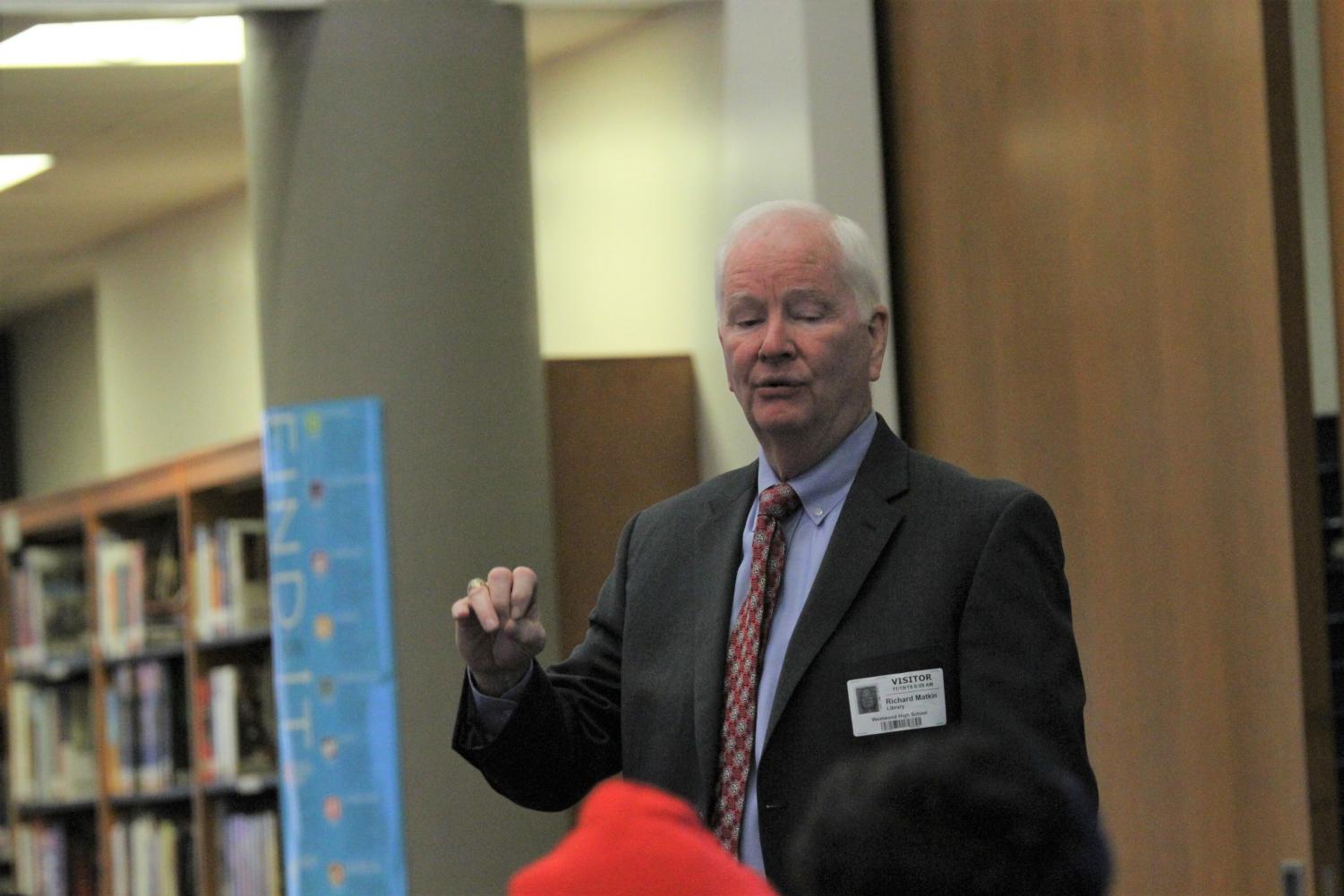

“I thought it was very important that students have real live business connections,” director of public finance of the southern region of Wells Fargo securities Richard Matkin, former teacher and Plano ISD CFO, said. “Very seldom can you take education and step into the business world and this is an opportunity that students got to visually see and learn about business in action for your school district. That was important that I’m making that connection being a former educator who is now in the business world.”